8 Lessons to Teach Kids about Credit for Grades K–12

Breaking up the concepts throughout the life of an aging child helps to slowly integrate the idea of using credit into their minds—making it easier for them, when they’ve grown, to have a less jarring transition from high school to adult life.

Teach Children Credit Basics

Grades K–5

1. The Difference Between Credit and Debit

Ultimately, the easiest way to explain credit versus debit is by showing kids that credit isn’t owned. Kids start to understand the concept of ownership at a pretty young age. An explanation of credit as little as, "It’s like when little Timmy lends you a pencil, you have it and you can use it, but you have to return it afterward," would suffice. Though credit might be a little more complicated than that, the most important thing for younger kids to recognize is that using credit means using borrowed money, not personal money.

2. Give & Take

Since all children really need to understand is that credit is borrowed money, you can help them by introducing a simple game—one that's similar to GoFish:

ACTIVITY

What you’ll need: Playing cards, of any sort, so long as they have the ability to be matched—GoFish cards, normal playing cards, uno cards, etc.

Instructions:

Tell the kids you’ll be playing a simple borrowing game. Their goal is to get as many matching cards as possible.

Have each one start with five cards and put the rest of the cards face down in the middle. Next, instruct the kids to lay their "money" or cards down for everyone to see.

Explain to the children that the goal of the game is to have the most matching cards in the group by the time the middle pile runs out or no one can make any more moves. BUT…warn the kids that there are two simple rules.

- Each turn, a player can choose to "borrow" one card from another pile in the circle or pull from the middle. (This represents the idea of borrowing money or credit.)

- In order to keep whichever card they take, they must give up one of their cards. (Though the card they give back might be different, reiterate that the lesson is to return a card for a card, no matter that card. This represents paying back credit.)

The kid at the end of the game with the most matches wins.

Teach Middle Schoolers about Building Credit and Credit Scores

Grades 6–8

3. Maintaining a Good Credit Score

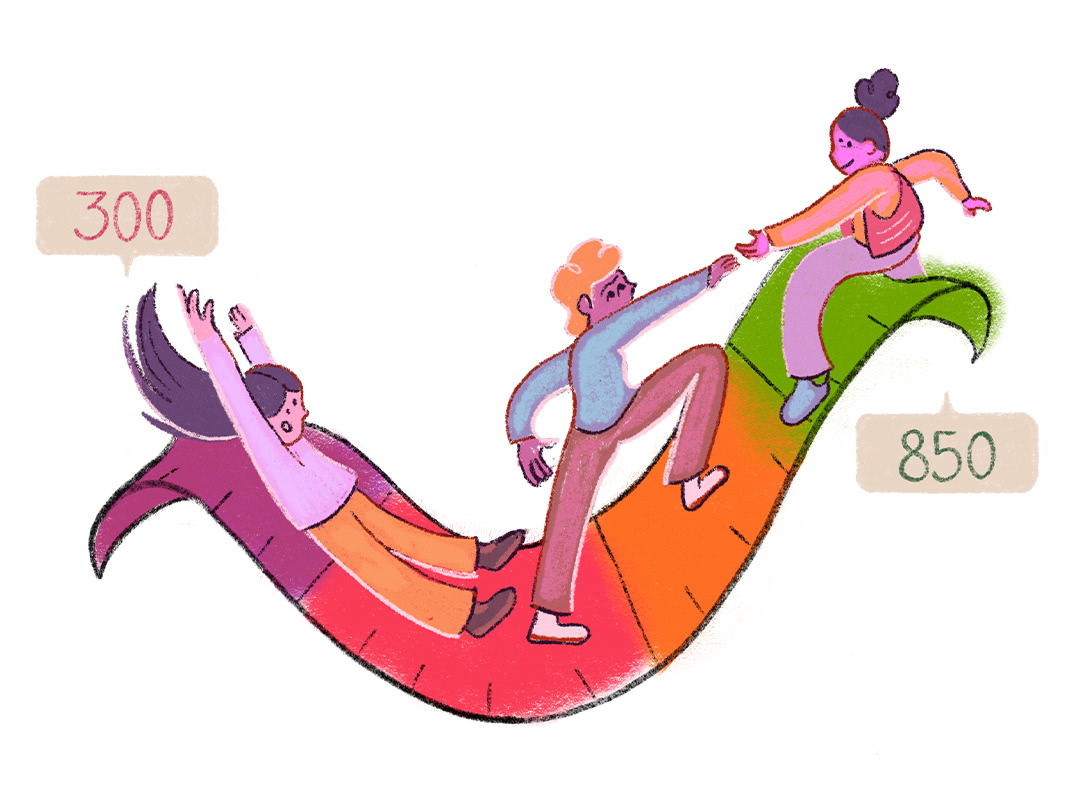

By this age, students understand that their actions have repercussions. Teaching middle schoolers that a credit score is a grading system for how well they return what they borrow shouldn’t be that far off from what they're used to hearing. If it helps, you can always write up an example and show them that a score of 300-579 is given to someone who struggles paying back borrowed money, 580-669 is given to someone who is decent at paying back borrowed money, 670-739 is someone who is good at it, 740-799 is someone who is very good at it, and 800-850 is when someone is excellent at it.

Credit cards have a limit that sets how much a person can borrow at one time. The better their "grade," or credit score, the higher limit they'll be trusted to borrow at a given time. Though they might have a $7,000 limit, that doesn’t mean they should rush to spend it…actually quite the opposite. You see, using a lot of an available balance is bad for a credit score, while using less than 30% is good. It’s also always best to remind middle school kids that it’s good to use a little bit of a credit balance each month and pay it off completely at the end of the month.

4. Building Credit

Credit isn’t something that just magically appears…it’s built off of positive credit history or actions someone makes when they start borrowing. It’s important to teach kids that in order to build their credit score, they must first start borrowing. This means opening up a credit line, taking out a loan—whether it's a student loan or not—etc.

5. ACTIVITY–Using Credit

You can help kids practice using credit by allotting them a certain amount of points or fake money each week or month. These points can be used to win little prizes throughout the week or even remedy the absence of a school supply like a notebook or a pencil. Once a student uses all the points for the week, they can be given the option to use points from the following week on credit—so long as they understand they will have to pay them back with their points next week, meaning they won’t be able to use them then. You may even consider charging interest for points or money used on credit.

Teach High Schoolers How to Use Credit

Grades 9–12

6. Establishing Credit

A credit report contains a history of borrowing habits for every credit user. Without a good credit history, vendors have no way of knowing if someone is trustworthy to loan to. Since credit is such a vital part of post-teen life, it’s important for kids to start establishing a credit history as soon as possible. Explain to the students that their credit history begins when they get their first credit card, take out loans, or even piggy-back off their parent’s credit. Meaning, they need to be using it carefully right from the start in order to build up good credit. Here are some ways for them to get started:

- Find a Job—in order to get a credit card, they’ll need to prove that they have the income to pay back anything they borrow.

- Apply for a secured credit card—Choosing the right credit card can be a difficult process, especially when it's someone's first time. Once they turn 18, they’ll be able to start applying for credit cards. Secure credit cards are great for a first-timer because they have a lower limit than traditional credit cards.

- Become an authorized user on their parent's card—at the age of 18, parents can add a child as an authorized user on their card. That child doesn’t necessarily even have to use their parents card for it to positively affect their personal credit score.

7. Yearly Fees & Interest

Similar to any subscription service, some credit cards have a yearly fee. So it’s best to choose a credit card without a yearly fee—especially if you’re just getting started. Explain that on top of watching out for yearly fees, it's important to be mindful of APRs(annual percentage rates) or the amount of interest charged over 12 months. For example, a credit card with a 30% APR means the user will owe roughly 30% of their outstanding balance over the span of a year. In other words, if a $2,000 balance is carried over a full year, the user will owe roughly $600 dollars worth of interest at the end of that year. Just remember, a smaller interest rate and yearly fee is usually better.

8. ACTIVITY–Loans

Loans are generally used when someone needs or wants something that they can’t afford now or in the immediate future. Instead of dropping a huge sum of money right off the bat, it's sometimes needed to borrow that amount from an institution and pay them back in increments over a decided time period. This concept is easily applied to the classroom in the form of assignments and/or grades.

This activity helps teens understand the repercussions of getting a loan and how to manage paying them back.

Note: you may choose to do this as a one-time offering, only offer it on certain assignments, or offer it on any assignment, at any time.

For this activity, students aren’t borrowing money from you, but rather borrowing time. In other words, this activity invites you to add something called an "assignment loan" to your classroom.

Explain to the class that if a student is unable to complete an assignment because of a sporting event, illness, or other event, they have the option of putting that assignment on loan. Though this loan gives your students extra time to finish an assignment, it comes at a price.

The rules of the loan are as follows:

Before the loan is approved, every student needs to fill out a "loan application." In this application, they’ll state…

- Why they need the loan (a sporting event or holiday took up their time, they forgot to do the assignment, etc.)

- Their "credit history" (how often they’ve turned things in on time in the past)

- Their requested length of time (an extra day, week, etc.)

You, as their teacher, reviews the application and decides whether to accept or reject it. If you decide to loan them the time, then they have that amount of time to complete the assignment. You, as the teacher, can set an "interest rate." This rate reflects the percent that is lost from turning the assignment in late. You could choose to have a standard interest rate for the whole class or you can choose to set a rate depending on each student and their "credit history"—or how often they've stuck to previous deadlines.

At the end of the day, you’re giving students the chance to complete work while also learning vital accountability skills.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.